Notaries

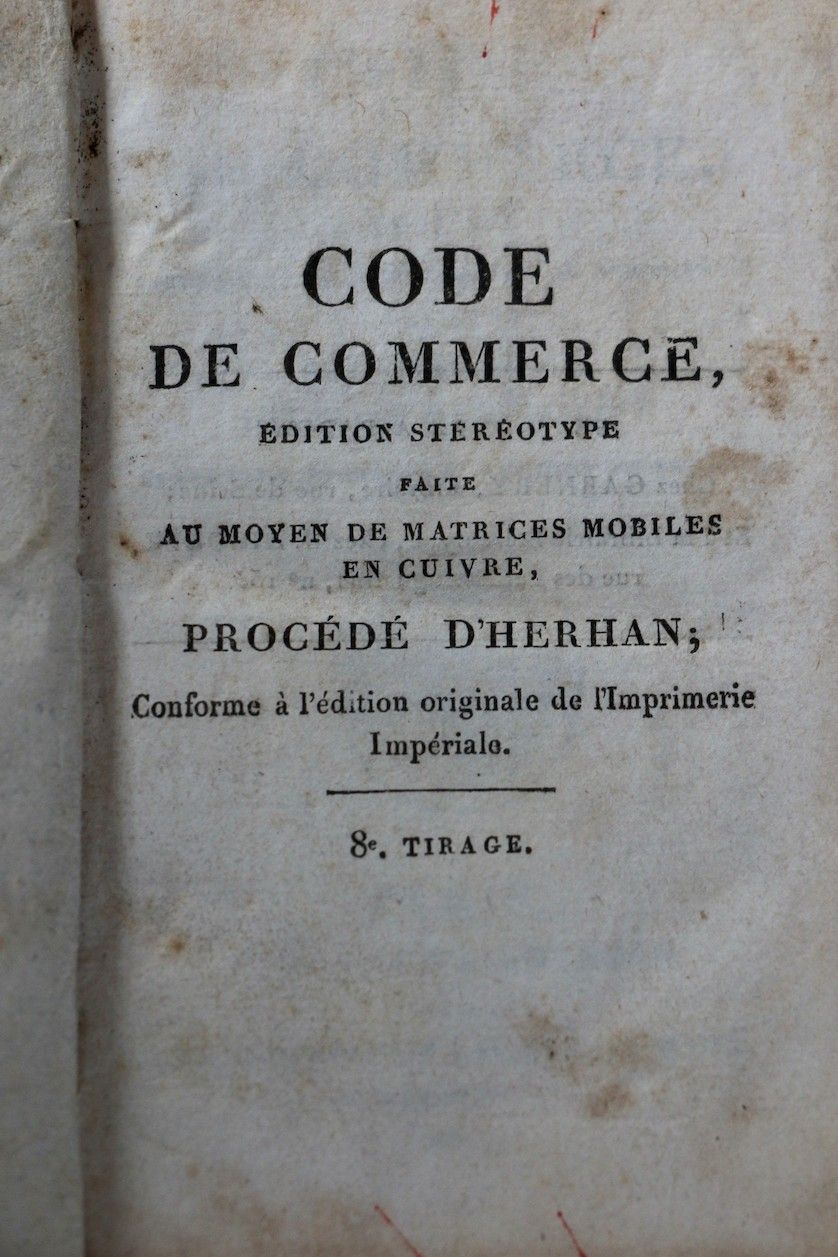

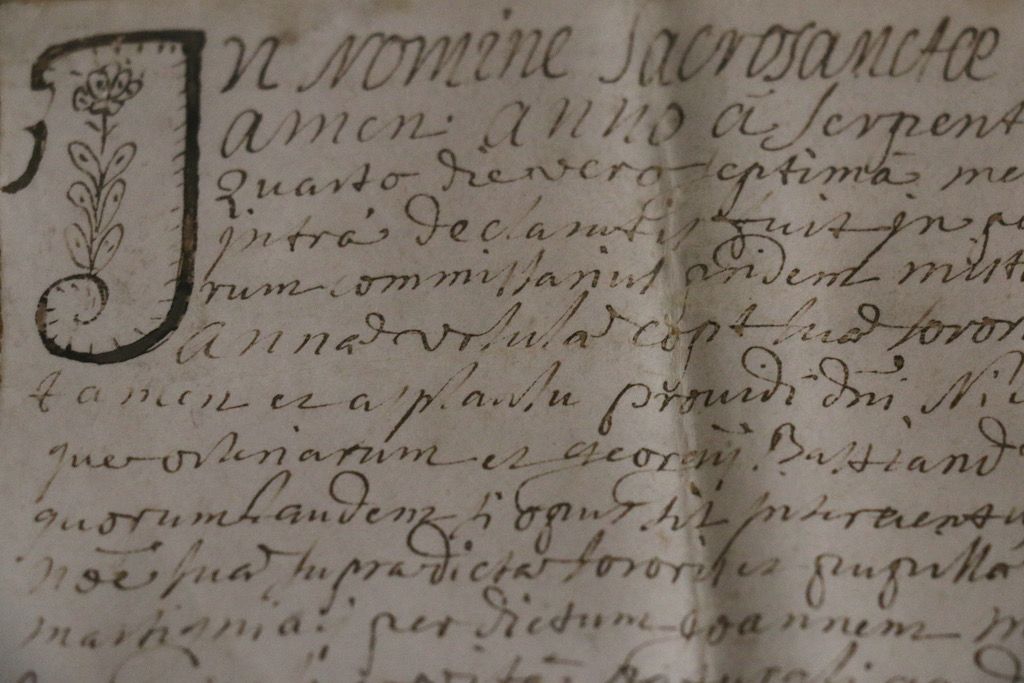

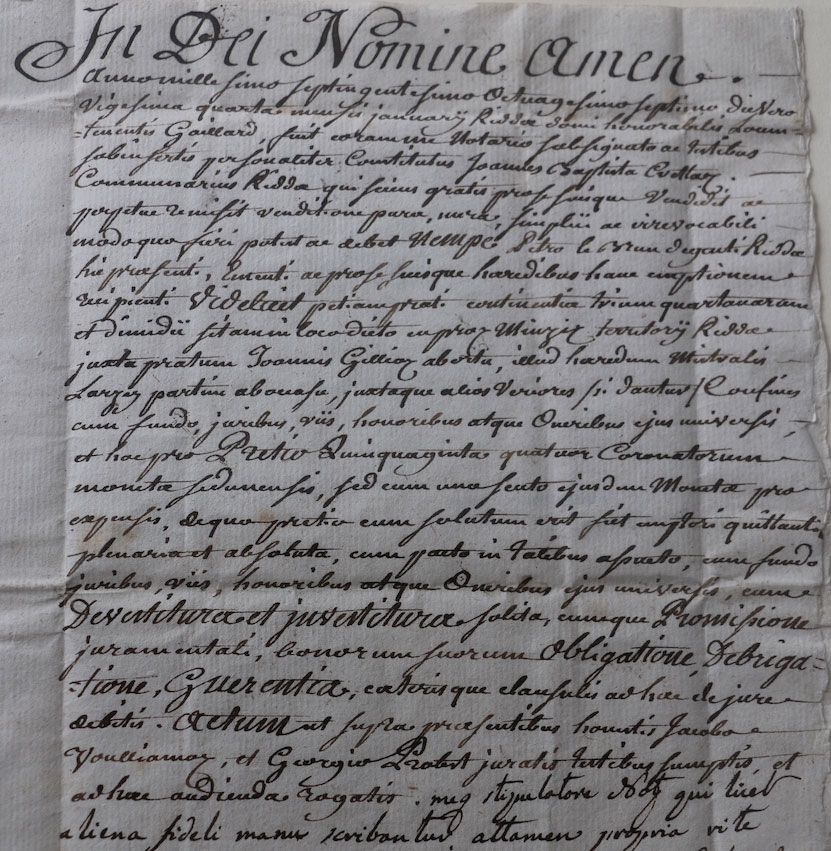

The notary is an organ of the voluntary jurisdiction which exercises a state function. He is a public officer exercising his ministry independently, under the supervision of the state.

The notary alone has the right, subject to the powers conferred by law on other public officers or authorities, to record declarations and findings which the parties concerned must or wish to have authenticated.

Services

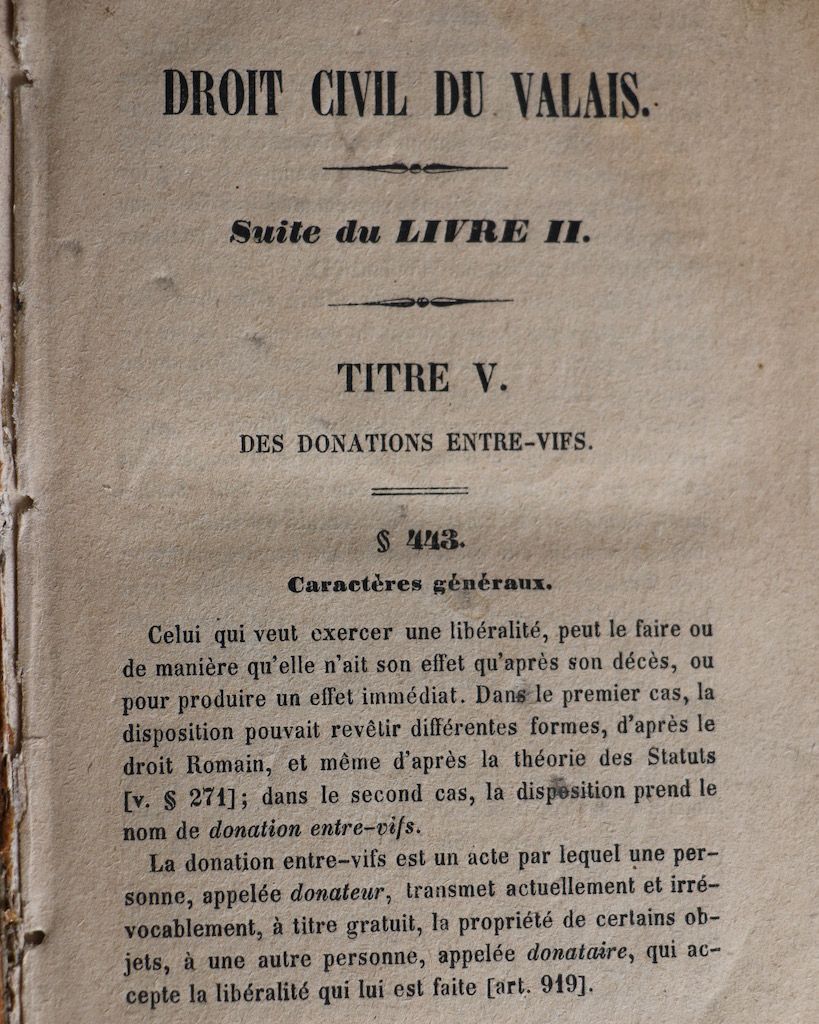

Real estate law

- Deed of purchase and sale of real estate

- Deed of constitution of mortgages

- Deed of easement

Inheritance law

- Deed of constitution of a will

- Deed of constitution of an inheritance contract

- Deed of partition of an estate

Matrimonial property law

- Deed of incorporation of companies

Corporate law

- Deed of incorporation of companies

Notary fees

For notarial acts, the sums improperly called "notary's fees" are divided between the taxes that the notary collects, and which are paid to the State (land register fees, trade register fees, etc.) and to local authorities (land registry fees), the notary's fees and his expenses (or disbursements). The latter two items are fixed by the Regulation fixing the tariff of notaries’ fees and disbursements.

For information purposes, and without considering the notary’s possible disbursements and fees, this fare provides for the usual notarial deeds, such as real estate sales, mortgages or company incorporations, that the notary receives the following proportional emoluments, whose different brackets add together:

| For the bracket of CHF 0 to 5000.- | 200.- |

| For the bracket of CHF 5001 to 200'000.- | + 5 per thousand |

| For the bracket of CHF 200'001 to 500'000.- | + 4 per thousand |

| For the bracket of CHF 500'001 to 1'000'000.- | + 3 per thousand |

| For the bracket of CHF 1'000'001 to 10'000'000.- | + 2 per thousand |

| Beyond CHF 10'000'001.- | + 1 per thousand |

For the mortgages, the proportional emoluments are calculated as follows:

| For the bracket of CHF 0.- to 10'000 francs | 200.- |

| For the bracket of CHF 10'001.- to 100'000 francs | + 5 per thousand |

| For the bracket of CHF 100'001.- to 200'000 francs | + 4 per thousand |

| For the bracket of CHF 200'001.- to 500'000 francs | + 3 per thousand |

| For the bracket of CHF 500'001.- to 1'000'000 francs | + 2 per thousand |

| Beyond 1'000'000 francs | + 1 per thousand |

In addition to these amounts, for notarial deeds related to real estate transactions, the fees and expenses of the Land register are calculated according to articles 14 to 17 of the Law on transfer rights and articles 89 to 100 of the Ordinance on the keeping of the cantonal Land register of 17 April 1920. For deeds related to the commercial law of companies, the fees and expenses of the trade register are set out in the Federal Ordinance on Commercial Register Fees.

The notary’s emoluments vary from canton to canton. In theory, the notary has a monopoly in his canton, particularly regarding real estate acquisitions. However, it is interesting to note that for deeds relating to company law, the notary's execution of the deeds may take place in a canton other than that of the company's registered office. The fees charged by notaries may therefore vary significantly from one canton to another. The various cantonal notarial associations will provide you with information on their members' fees.

The choice of the notary is generally the purchaser’s, since in principle it is the latter who will be responsible for the costs related to notarised deeds.

Liens Juridiques

Cantonal Law

- Systematic collection of Valais legislation

- Association of Valaisan Lawyers

- Association of Valaisan Notaries

- Official website of the State of Valais

- Systematic collection of Geneva legislation

- Systematic collection of Vaud legislation

- Systematic collection of Fribourg legislation

- Systematic collection of Neuchâtel legislation

- Systematic collection of Zurich legislation

- Systematic collection of Bern legislation